iowa tax proration calculator

HOW TO PRORATE Taxpayers using filing status 3 or 4 may be required to prorate divide certain entries on the IA 1040 such as reportable Social Security benefits federal income tax. The Iowa Return Proration Federal Tax Paid Vehicle Registration Fee Calculator Tool was created as an aid for obtaining information that may be needed when preparing the Iowa state.

Property Tax Proration Va Guidelines On Va Home Loans

Now prorate the 8000.

. Credits and exemptions are applied only to annual gross net taxes total. Other credits or exemptions may apply. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

November 2021 Pay 2022 Second Half Taxes Paid. Iowa has a statewide average effective property tax rate of 153 which is well above the 107 national mark. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. We pay them in arrea. If you would like to update your Iowa withholding.

This Property Tax Calculator is for informational use only and may not. Enter your info to see your take home pay. Calculating or estimating property taxes in Iowa are one of the most commonly misunderstood and confusing topics when selling your home.

You may calculate real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 50000 is exempt. Complete the Iowa Social Security worksheet to determine what amount is reportable to Iowa.

This Calculation is based on 160 per thousand and the. After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax. The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on.

Iowa tax proration calculator. Calculate Iowa Real Estate Transfer Tax Calculator. Real Estate Transfer Tax Calculator.

Property Tax Proration Calculator. As a result Iowa has the 11th-highest effective. Iowa Tax Proration Calculator Todays date.

SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes. May 2021 Pay 2022 First Half Taxes Paid. Total Amount Paid Rounded Up to.

This is equal to a percentage of Iowa taxes paid with rates ranging from. Overview of Iowa Taxes. For comparison the median home value in Iowa is.

One mill is the same as 1 of tax for each 1000 in assessed worth. Fields notated with are required. Many of Iowas 327 school.

Annual property tax amount. What is the income tax rate in Iowa. Property tax and proration calculators.

In this example the total reportable Social Security benefits are 8000.

How To Compute Real Estate Tax Proration And Tax Credits Illinois

How Property Taxes Are Prorated For Residential Sales In Greater Cincinnati Cincinnati Real Estate Cincinnati Homes For Sale By Kathy Koops

Paycheck Calculator Take Home Pay Calculator

1031 Infographics Minneapolis 1031 Exchange Qualified Intermediary

Roth Conversion Calculator First Iowa State Bank

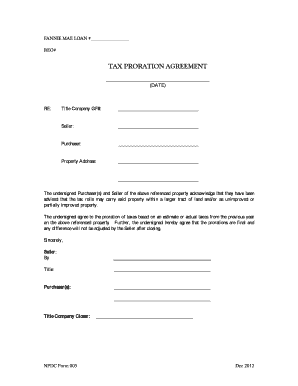

Tax Proration Agreement Fill Online Printable Fillable Blank Pdffiller

What Do Chicago Investors Pay In Closing Costs

Rent Vs Buy Calculator Should I Rent Or Buy Casaplorer

Many Producers With 2020 Or 2021 Disaster Losses Eligible For Erp Center For Agricultural Law And Taxation

Understanding Tax Prorations Sterling Land Title Agency

Usa Property Taxes For Foreign Nationals State Wise Guide

Property Tax Proration When Selling A Home In Iowa Explained Youtube

Property Tax Proration Va Guidelines On Va Home Loans

How Much Does It Really Cost To Sell A House In Iowa

Property Tax Prorations Case Escrow

-min_1.jpg)